Pay later apps are transforming the way people shop, pay bills, and manage expenses in India. With disruptions in services like Paytm Postpaid, users are turning to alternative platforms that provide seamless credit solutions. In this article, we’ll review some of the best pay later apps in India, highlighting their features, pros, and cons to help you choose the right one for your needs.

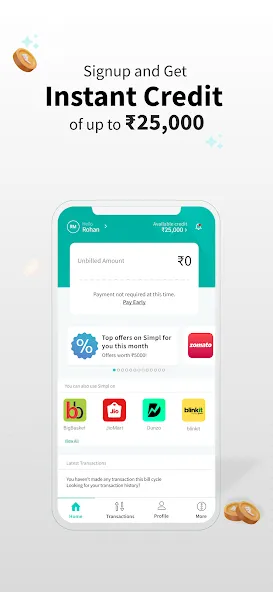

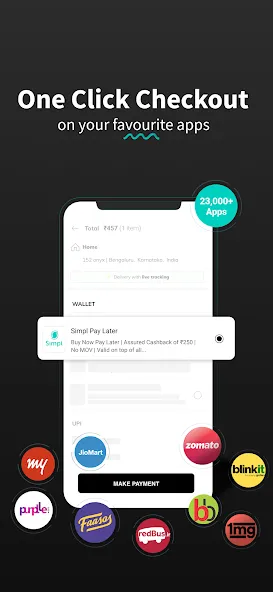

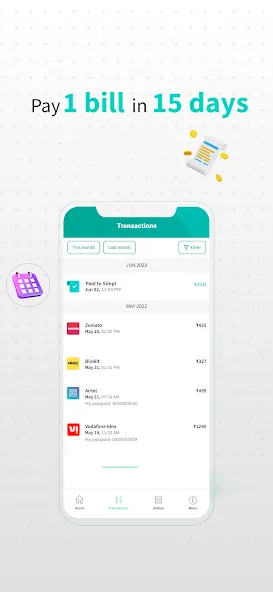

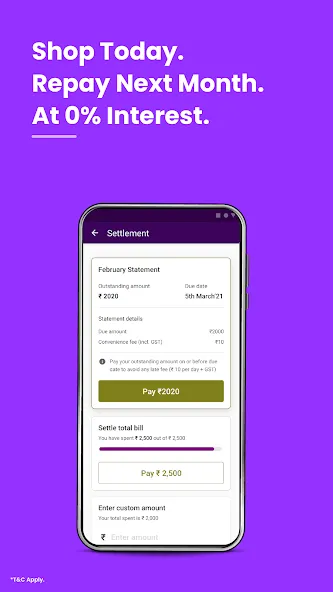

1. Simpl – A Top Choice Among Pay Later Apps

Simpl is known for its effortless transactions and partnerships with major brands like Zomato, BigBasket, and Blinkit. It offers a credit limit of up to ₹25,000 with no interest on repayments. Simpl also supports utility bill payments, making it a versatile choice.

Key Features:

- No OTPs or passwords required for transactions.

- Supports payments for utilities like electricity, gas, and water.

- Late payment penalty: ₹250.

Pros:

- Hassle-free transactions.

- Interest-free credit.

- Widely accepted by popular brands.

Cons:

- Limited credit limit.

- Late payment penalties.

Best For: Users seeking a simple, interest-free pay-later solution.

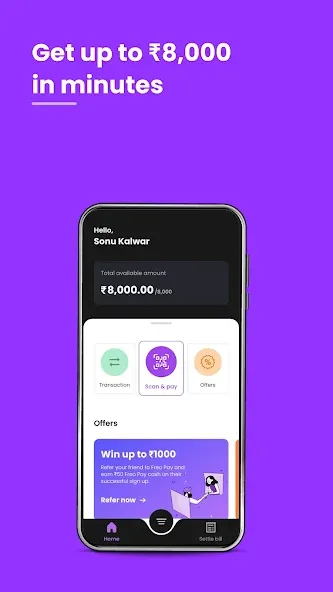

2. Freo Pay – Offline Convenience for Everyday Shopping

Freo Pay stands out for its offline utility, offering a credit limit of up to ₹10,000. It’s designed for local stores and vendors and works seamlessly with QR codes from platforms like Google Pay, PhonePe, and Paytm.

Key Features:

- Focus on offline transactions.

- No hidden charges and a nominal convenience fee.

Pros:

- Ideal for offline shopping.

- Easy QR code payments.

- No hidden fees.

Cons:

- Low credit limit.

- Limited functionality for online shopping.

Best For: Users needing small credits for daily offline transactions.

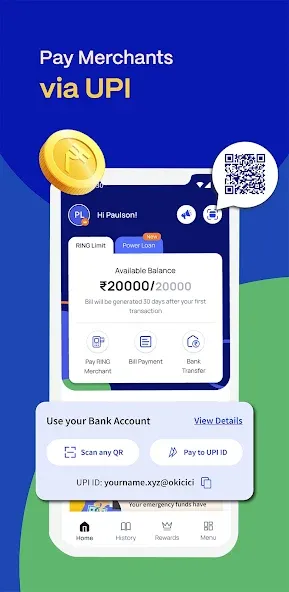

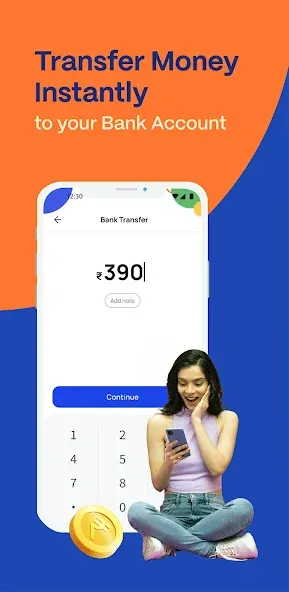

3. Ring – Versatile Pay Later App with Unique Features

Ring offers flexible credit options ranging from ₹35,000 to ₹2,00,000 and supports both online and offline payments via UPI and QR codes. Its standout feature is the ability to transfer credit to a bank account, though larger limits may incur high interest rates.

Key Features:

- Flexible credit limits.

- Bank account transfer option.

- Interest rates: 18%-36% per annum for larger credit limits.

Pros:

- High credit limits.

- Supports online and offline payments.

- Unique bank transfer feature.

Cons:

- High interest rates on larger credit amounts.

- Complex terms for advanced features.

Best For: Users looking for high credit limits and versatile payment options.

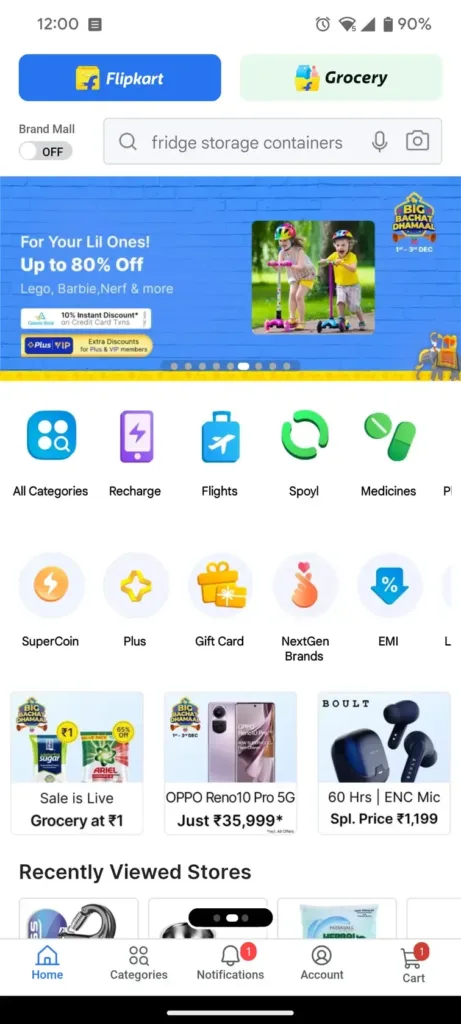

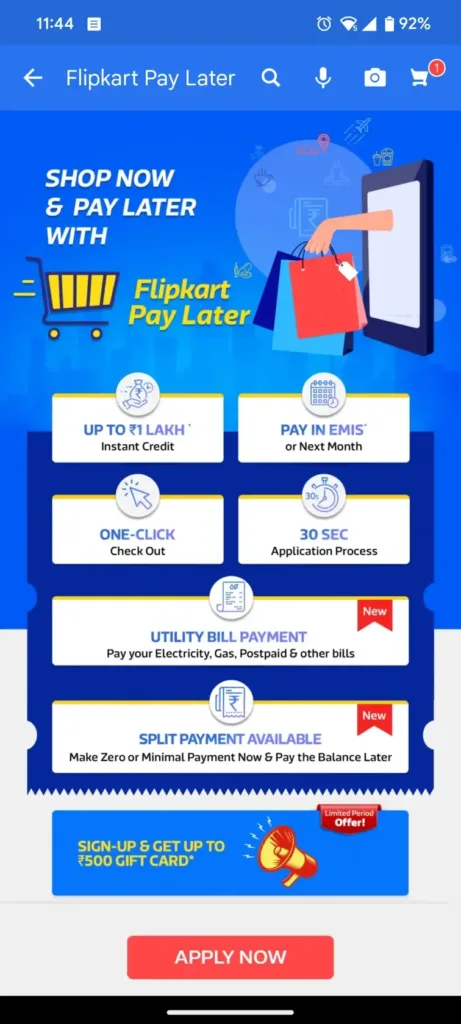

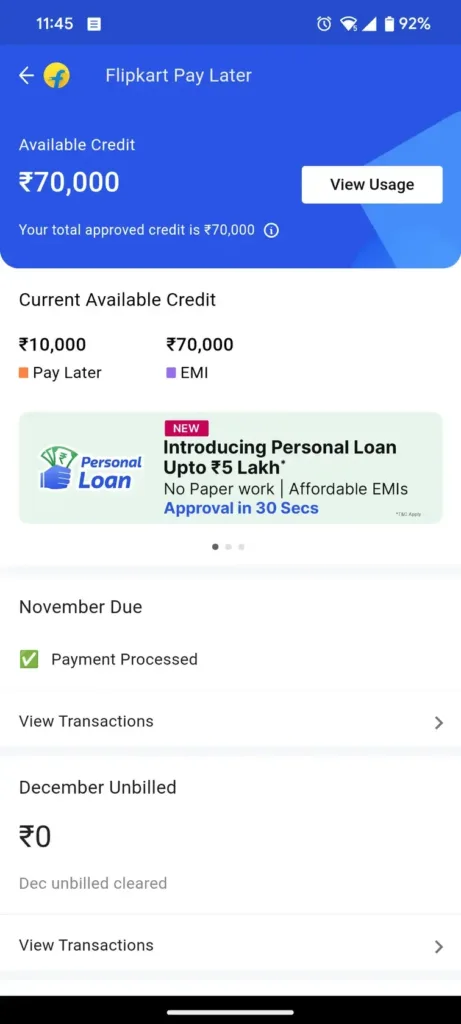

4. Flipkart Pay Later – Exclusive Shopping and Payment Options

Designed for Flipkart shoppers, this app offers credit up to ₹1,00,000, supporting EMI payments and bill settlements. It’s an excellent option for frequent Flipkart users.

Key Features:

- Credit usable for Flipkart and affiliated platforms.

- EMI options available.

Pros:

- High credit limit.

- Ideal for shopping on Flipkart.

- Supports multiple payment options.

Cons:

- Limited to Flipkart and its partners.

- No offline utility.

Best For: Regular Flipkart shoppers.

5. RuPay Credit Card – A Bank-Assured Pay Later Alternative

RuPay Credit Card offers a unique solution by combining traditional credit card benefits with pay-later functionality. Payments can be made via UPI IDs and QR codes, offering flexibility for both online and offline transactions.

Key Features:

- UPI and QR code payments.

- Rewards and bonuses typical of credit cards.

Pros:

- Flexibility in payments.

- Credit card benefits included.

- No need for additional apps.

Cons:

- Requires a RuPay credit card.

- Limited to users with compatible bank accounts.

Best For: Users who already have or prefer using RuPay credit cards.

Choose Your Pick

| App | Key Features | Best For | Rating |

|---|---|---|---|

| Simpl | Interest-free credit, utility bill payments. | Hassle-free transactions. | 8/10 |

| Freo Pay | QR payments, offline shopping utility. | Small daily offline transactions. | 7.5/10 |

| Ring | High credit limits, bank transfers. | Versatile payment needs. | 9/10 |

| Flipkart Pay Later | High credit limit, EMI options. | Regular Flipkart shoppers. | 8.5/10 |

| RuPay Credit Card | UPI/QR payments, rewards and bonuses. | Traditional credit card users. | 8/10 |

Key Takeaways

- Simpl is perfect for everyday transactions with popular brands and utility bill payments.

- Freo Pay is best for offline shopping needs.

- Ring is the best choice for users requiring high credit limits and bank transfers.

- Flipkart Pay Later is unbeatable for Flipkart enthusiasts. A similar option is available for Amazon users as well.

- RuPay Credit Card offers flexibility with added credit card benefits.

Pro Tip: Always read the terms and conditions of each app carefully to avoid hidden fees or penalties. Choose a pay-later app that aligns with your spending habits and repayment capabilities.

Let us know which app works best for you in the comments below!